CPOpen: Your Gateway to Current Affairs

Stay updated with the latest trends and insights across various topics.

Insurance Smackdown: Finding the Best Bang for Your Buck

Discover the ultimate showdown in insurance! Uncover tips to get the best coverage without breaking the bank. Don't miss out!

Understanding Insurance Premiums: What Influences Your Costs?

Understanding insurance premiums is essential for anyone looking to protect their assets and financial well-being. Several factors influence the costs of your premiums, including your age, driving history, location, and even credit score. Insurance companies assess the level of risk associated with each policyholder, which directly affects how much you will pay. For instance, younger drivers often face higher premiums due to a lack of driving experience, while those with a clean driving record can benefit from lower rates.

In addition to personal factors, external elements also play a role in determining your insurance costs. Market conditions can lead to increases or decreases in premiums, as can changes in local laws or regulations. Furthermore, the type of coverage you choose—be it basic or comprehensive—will also impact your monthly expenses. It's crucial to regularly review your policy and shop around for quotes to ensure you are getting the best value for your insurance premiums.

Top 5 Insurance Myths Debunked: What You Really Need to Know

Insurance can often feel like a maze of information, leading to many misconceptions that can end up costing you. One common myth is that all insurance policies are the same, when in reality, coverage options can vary widely. Understanding the specific terms and conditions is crucial. For instance, while some policies may cover natural disasters, others might exclude them completely. It's essential to read the fine print to know exactly what your policy entails.

Another prevalent myth is that you don’t need insurance if you're healthy. This notion can be dangerously misleading. Life is unpredictable, and having insurance serves as a safety net for unforeseen circumstances. Additionally, many policies feature benefits that can help with preventive care, which is essential in maintaining long-term health. In essence, insurance is not just about coverage; it's about planning for the unexpected.

How to Compare Insurance Plans: A Step-by-Step Guide

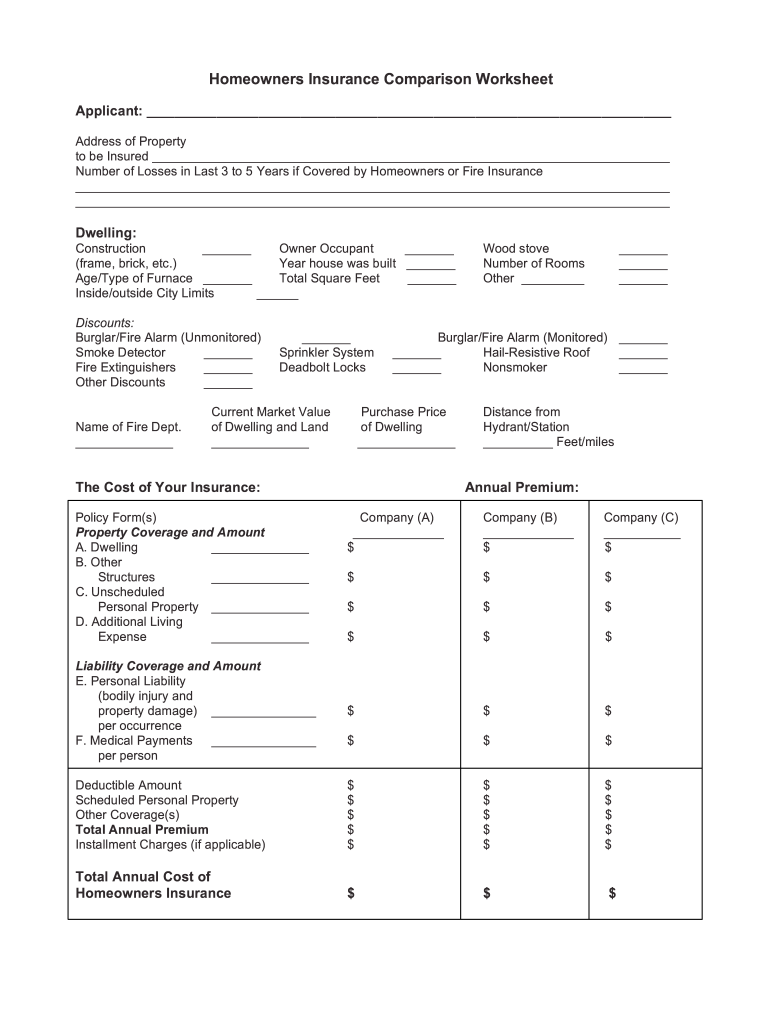

Comparing insurance plans can seem overwhelming, but breaking it down into manageable steps can simplify the process. First, gather your information by listing your needs, preferences, and budget. Consider what types of coverage you require, such as health, auto, or home insurance. Make a list of potential providers, and take note of their plan features, premiums, deductibles, and out-of-pocket maximums. This initial research will help you narrow down your options and focus on plans that fit your criteria.

Once you have a shortlist, it's time to analyze and compare the plans side by side. Create a comparison chart that includes key details such as coverage limits, exclusions, and premium costs. Don't forget to check for customer reviews and ratings of each provider, as these can provide insights into claims processes and customer service. Finally, take your time to weigh the pros and cons of each plan before making a decision, ensuring it aligns with your specific needs and financial situation.