CPOpen: Your Gateway to Current Affairs

Stay updated with the latest trends and insights across various topics.

Why Your Couch Deserves Better: The Case for Renters Insurance

Discover why protecting your couch with renters insurance is a must. Don't let mishaps ruin your comfort—find out more!

5 Surprising Reasons Your Couch Needs Renters Insurance

Many renters underestimate the importance of renters insurance when it comes to protecting their belongings. One surprising reason your couch needs renters insurance is that it can be a target for theft. A stylish or expensive couch can make your home more appealing to thieves, and without renters insurance, you may be left with significant financial losses if it gets stolen. Additionally, if someone breaks into your home and damages your couch in the process, your renters insurance can help cover the repair costs.

Another reason to consider renters insurance for your couch is the risk of accidental damage to it. Whether it's a spilled drink, a pet mishap, or an unexpected incident during a gathering, these accidents can lead to costly repairs or replacements. With renters insurance, you can feel secure knowing that you have coverage for such incidents. In many cases, policies can even cover furniture beyond the living room, so you’re not just protecting your couch but your entire furniture set as well.

Is Your Furniture Protected? The Importance of Renters Insurance

When it comes to renting a home, many people often overlook an essential aspect of their financial security: renters insurance. This type of insurance is designed to protect your personal belongings, including furniture, from unexpected events such as theft, fire, or water damage. Without proper coverage, you could find yourself faced with significant out-of-pocket expenses to replace or repair your belongings. It's crucial to understand that your landlord's insurance typically covers only the physical structure of the building, not your personal items.

In addition to covering furniture, renters insurance can offer liability protection, safeguarding you from legal issues should an accident occur in your rental property. For example, if a guest were to get injured while visiting, your policy could help cover their medical expenses or any associated legal fees. Taking this proactive step ensures that you can enjoy your living space without the fear of financial ruin from unforeseen incidents. Investing in renters insurance not only protects your furniture but also provides peace of mind and security for your entire household.

What Does Renters Insurance Cover? A Breakdown for Your Belongings

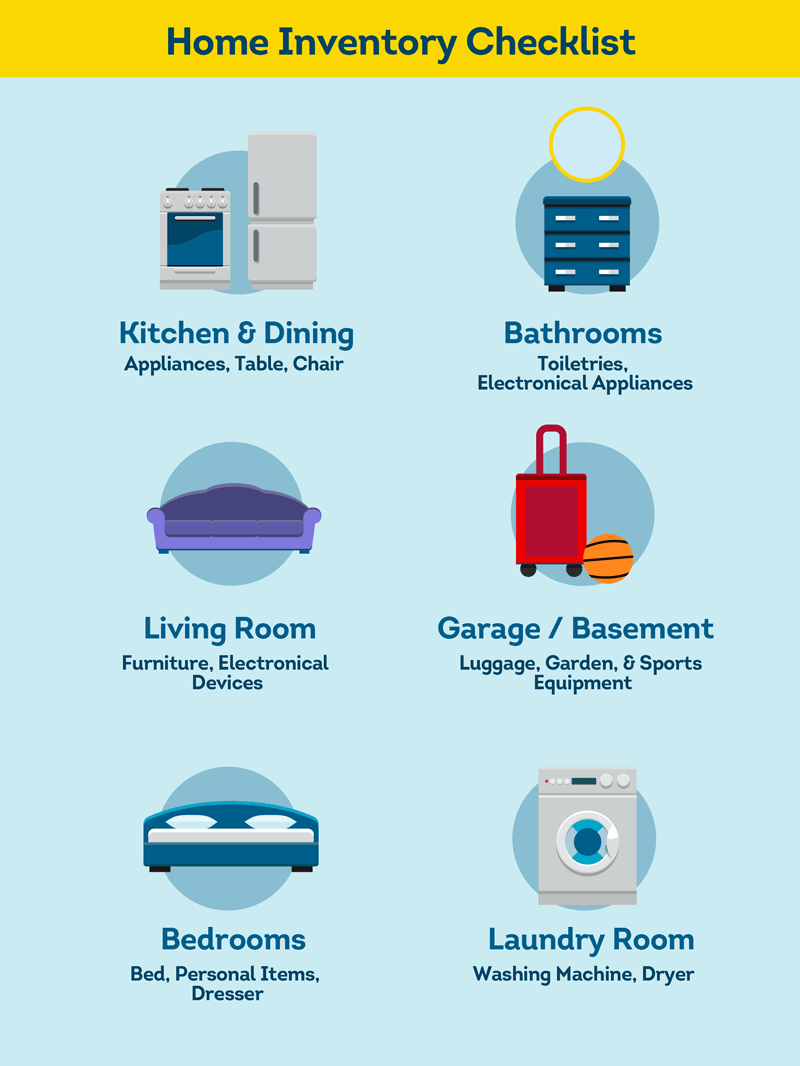

Renters insurance provides valuable protection for tenants, covering a range of unexpected events that can lead to loss or damage of personal belongings. Generally, it includes coverage for personal property, which encompasses items such as electronics, clothing, furniture, and appliances. In the event of a covered peril, such as theft, fire, or vandalism, your belongings are protected up to a specified limit outlined in your policy. It's vital to take an inventory of your possessions and determine their value to ensure adequate coverage.

Additionally, most renters insurance policies offer liability protection, which guards you against claims made by others for injuries or damages that occur on your rented property. This can cover legal fees and settlements, making it essential for those who frequently entertain guests. Lastly, many policies also include additional living expenses (ALE) coverage, which assists with costs if your rented home becomes uninhabitable due to a covered event, allowing you to maintain your living standards while you repair or find a new place to live.