CPOpen: Your Gateway to Current Affairs

Stay updated with the latest trends and insights across various topics.

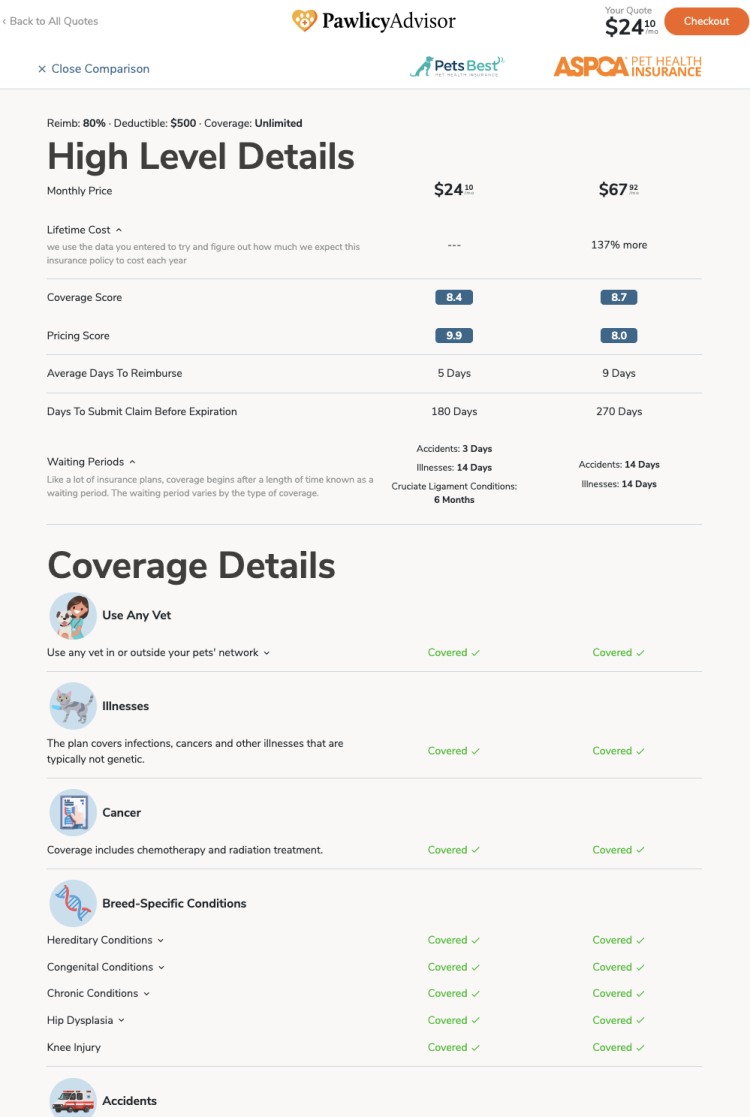

The Price is Right: Decoding Insurance Comparisons

Uncover the secrets behind insurance comparisons and find the best deals! Navigate the price maze with ease and save big on your premiums!

Understanding Insurance Premiums: What You Need to Know

Understanding insurance premiums is crucial for anyone looking to secure coverage for their assets, health, or life. An insurance premium is the amount you pay to maintain your policy, and it can vary widely based on several factors. These factors include your age, health status, the type of coverage you select, and even your credit score. For instance, when applying for auto insurance, companies typically assess your driving record along with the make and model of your vehicle. This means that being a safe driver can lead to lower premiums, while a history of claims might raise your costs.

When evaluating different insurance policies, it's important to understand the components that affect your insurance premium. Commonly, these include:

- Deductibles: The amount you pay out of pocket before your coverage kicks in.

- Coverage limits: The maximum amount your policy will pay for a claim.

- Risk factors: Variables unique to your situation, such as location and lifestyle.

Top Tips for Comparing Insurance Policies Effectively

When it comes to comparing insurance policies effectively, the first step is to identify your specific needs and priorities. Begin by creating a list of essential coverages that are important to you, such as liability, comprehensive, or collision coverage. Once you have a clear understanding of your requirements, request quotes from multiple insurance providers. This not only helps you to gauge the market rates but also aids in recognizing the variations in policy features. Remember to make use of online comparison tools, as they can save you considerable time by displaying different policies side by side for an easier evaluation.

After you have gathered the necessary quotes, delve deeper into each policy. Look beyond the premium costs and assess factors such as deductibles, coverage limits, and any exclusions that may apply. This can be done by utilizing a comparison checklist to ensure that all crucial aspects are reviewed. Furthermore, consider the reputation of the insurance company, including customer reviews and their claim settlement history. Ultimately, understanding the terms of each policy will empower you to make an informed decision that suits both your financial situation and your coverage needs.

Are You Getting the Best Deal? Questions to Ask When Comparing Insurance

Finding the best deal on insurance can be a daunting task, especially with the myriad of options available. To ensure you're getting the best value for your money, it's crucial to ask the right questions when comparing insurance policies. Start by inquiring about coverage limits: What is covered under each policy, and are there any exclusions that you should be aware of? Additionally, consider asking about deductibles and how they affect your premium. A lower premium might be enticing, but a high deductible could lead to higher out-of-pocket costs in the event of a claim.

Another important question to consider is how each insurance company handles claims. You might want to ask about the claims process: Is it straightforward, and what is the typical turnaround time for claims approval? Additionally, it can be beneficial to research customer reviews regarding customer service and the overall satisfaction of policyholders. Don't forget to inquire about available discounts—some insurers offer reductions for bundling policies or maintaining a good driving record, which can significantly affect the total cost of your insurance.